OUR PORTFOLIOS PERFORMANCE

At RetraiteInvest, we pay particular attention to transparency on the results obtained thanks to the lessons learned from our training. Below is the detailed performance of two types of portfolio that you could set up.

Figures quoted refer to past years, past performance is not a reliable indicator of future performance. Figures are expressed in USD, and earnings may be higher or lower based on exchange rate fluctuations.

STANDARD GROWTH

portfolio

9.11%

GROWTH XXL

portfolio

33.09%

the STANDARD GROWTH portfolio 9.11%

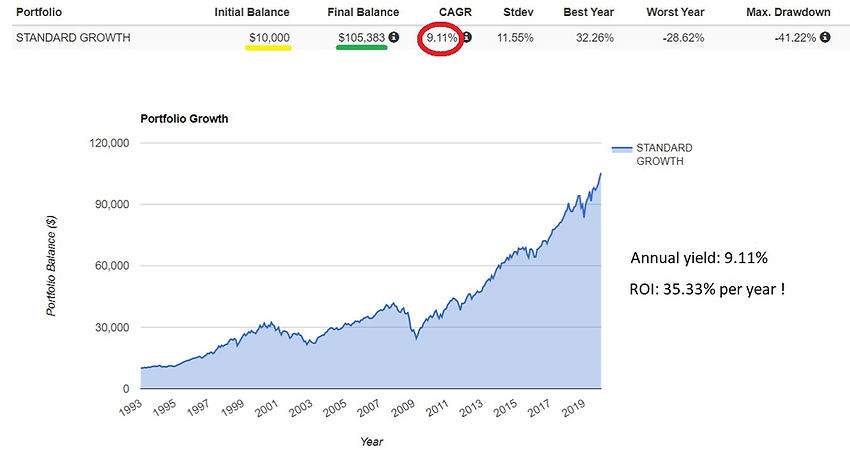

STANDARD GROWTH portfolio's return is 9.11% on an annual average over the period from 01 .01.1993 to 31.12.2019. Its endurance and its ability to weather crises, as in 2001 and 2008, make it an ideal ally for long-term investment.

.jpg)

monthly results for the

STANDARD GROWTH portfolio

the GROWTH XXL portfolio 33.09%

GROWTH XXL portfolio's return is 33.09% on annual average over the period from 01.01.2010 to 31.12.2019. The particular combination of leveraged assets enjoys high yield with measured volatility.

.jpg)

monthly results for the

growth XXL Portfolio